Ca used car sales tax calculator

With the trade-in however you can reduce the taxable value like this. California City County Sales Use Tax Rates effective April 1 2022 These rates may be outdated.

What Is The Actual Cost Of Owning A Car In 2022 Finder Canada

Multiply the net price of your vehicle by the sales tax percentage.

. On June 29 2020 California passed Assembly Bill AB 85 Stats. Calculate Used Vehicle Fees Vehicle Registration Fee Calculator Home. Lets say you are going to.

Also check the sales tax rates in different states of the US. Fortunately we provide a Tax Tags Calculator to help you determine your states used car sales tax requirements. Free calculator to find the sales tax amountrate before tax price and after-tax price.

Select View Sales Rates and Taxes then select city and add percentages for total sales tax rate. Calculate My Fees Fee Calculator Required Used Vehicle Fees Vehicle Information Do you know your. Military personnel stationed in California are exempt from payment of the vehicle license fee VLF on any vehicle owned or leased and registered in California provided.

35 000 - 5 000. To calculate the sales tax on your vehicle find the total sales tax fee for the city. Tax and Tags Calculator When purchasing a vehicle the tax and tag fees are calculated based on a number of factors including.

Also similar to DMV-related fees used car sales taxes vary by state. The calculator will show you the total sales. For a 30000 new car purchase with a 10000 trade-in value the tax paid on the new purchase with an 8 tax rate is.

Therefore you will be required to pay an additional 75 on top of the purchase price of the vehicle. Registration fees for used vehicles that will be purchased in California Disregard transportation improvement fee TIF generated for commercial vehicles with Unladen Weight of 10001. For a list of your current and historical rates go to the California City County Sales.

Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to California local counties cities and special taxation. The county the vehicle is registered in. The state sales tax on a car purchase in California is 75.

The minimum is 56. 635 for vehicle 50k or less. 775 for vehicle over.

30000 - 10000 8 1600 Some states do not offer any sales. While tax rates vary by location the auto sales tax rate typically ranges anywhere from two to six percent. Multiply the vehicle price.

8 and AB 82 Stats. Prince Edward Island has an HST rate of 15 meaning that normally you would 5 250 to pay in tax. California Sales Tax Calculator You can use our California Sales Tax Calculator to look up sales tax rates in California by address zip code.

4010 Calculating Use Tax Amount Chapter 4 Use Tax 4010 Calculating Use Tax Amount Each application subject to use tax must show the purchase price on the back of the. How to Calculate Arizona Sales Tax on a Car.

Car Tax By State Usa Manual Car Sales Tax Calculator

Sales Tax Calculator

Bc Sales Tax Gst Pst Calculator 2022 Wowa Ca

How To Calculate Find The Sales Tax Rate Or Percentage Formula For Calculating Sales Tax Rate Youtube

California Vehicle Sales Tax Fees Calculator

Car Tax By State Usa Manual Car Sales Tax Calculator

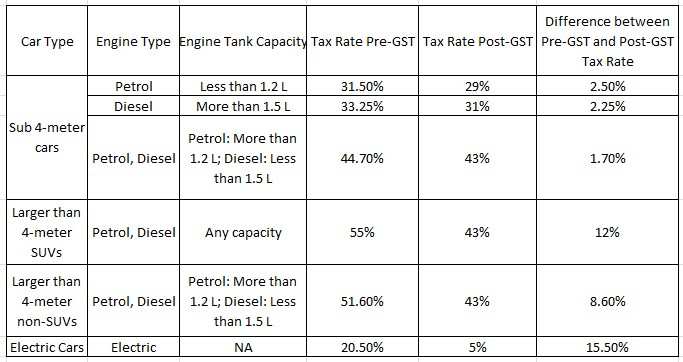

Auto Gst Rates What Are The Gst Rates On Automobiles In India Auto News Et Auto

Sales Tax Calculator

Reverse Sales Tax Calculator

Is There Tax On Auto Insurance In Ontario Complete Car

How To Calculate Sales Tax In Excel

California Sales Use Tax Guide Avalara

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

How To Calculate Sales Tax In Excel

How To Calculate Sales Tax In Excel

Quebec Sales Tax Gst Qst Calculator 2022 Wowa Ca

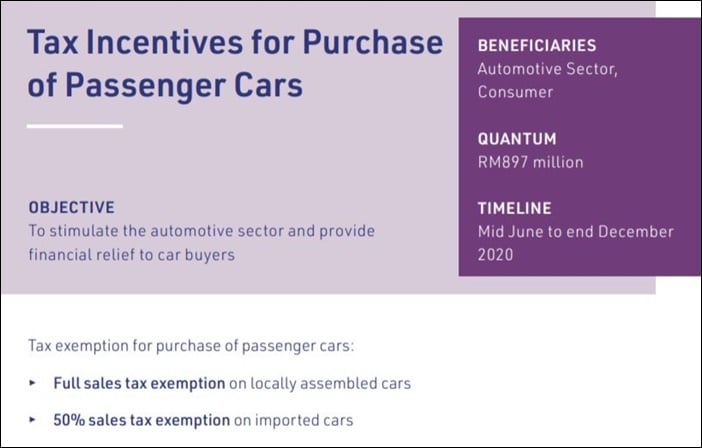

Sales Tax Exemption On Passenger Cars In Malaysia How Much Will You Save